Open Enrollment runs October 20 – November 9. Contact THT with any concerns.

EMI medical plan will be discontinued effective January 1, 2026.

Can I keep my medical providers?

Yes. The good news is that over 99% of the EMI providers you see today are already part of our new network! For the small number who aren’t, we are actively working to bring them on board.

If your provider ultimately decides not to join, don’t worry — your visits with them will still be covered for up to 12 months, giving you plenty of time to decide whether to continue with them or transition to a new in-network provider.

Will my medical benefits remain the same?

The Signature plan is the plan most comparable to your current EMI plan. It includes:

- $500 annual deductible per person

- The same copays for office visits and urgent care visits

- 20% coinsurance for other services

Do I need to do anything?

You do not need to do anything right now. We will automatically enroll you and your existing dependents in:

- Signature Medical Plan

- Dental PPO

- VSP Vision Standard

These plans are the closest match to your current EMI plan and come at no additional premium cost.

If you’d like to make other changes, such as the Advantage medical plan, Dental HMO, or Vision Plus — or make dependent changes, you can do so during the next Open Enrollment period.

How does this affect Dental and Vision?

There is no disruption to your dental or vision benefits. You’ll continue with the same carriers, and now you’ll also have more choices:

- Dental: Dental PPO (current plan) or the new Dental HMO option

- Vision: VSP Vision Standard (current plan) or the upgraded VSP Vision Plus

How will this affect my dependents living out of state?

Don’t worry—your dependents’ provider network is determined by the ZIP code we have on file. To ensure their claims are processed correctly, simply log into the member portal and update their ZIP codes.

Manage Your Benefits

The EMI plan was designed for CCSD employees and eligible retirees that reside in the rural areas of Clark County, including Mesquite and Logandale, as well as neighboring regions in Utah and Arizona. Although the EMI plan is no longer open to new members, its existing participants are grandfathered into this plan. EMI plan members can elect to move into our other plans during an open enrollment period.

Visit EMIHealth.com or download the EMI Health to manage all your benefits in one place.

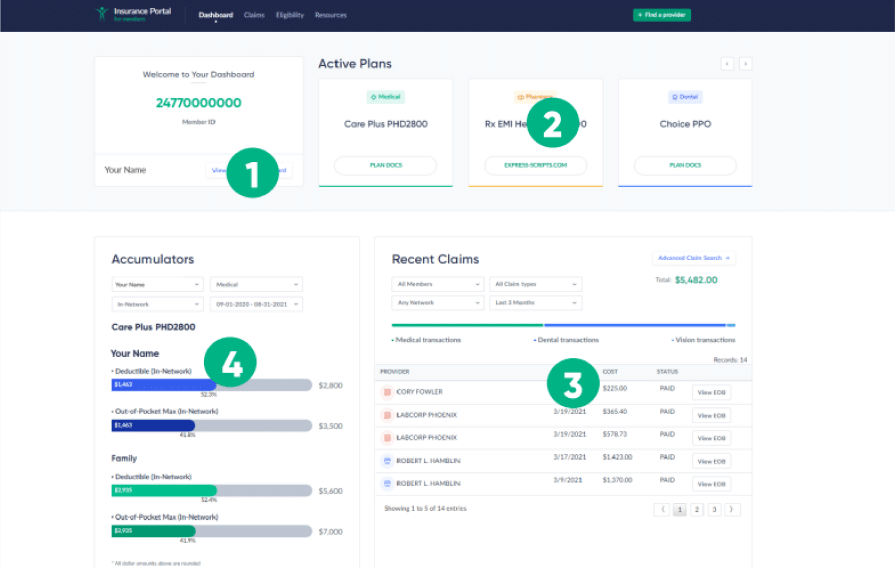

Navigating EMIHealth.com

- View your member ID card: View, download, or print your EMI Health ID card by clicking on the “View Your Member ID Card” button.

- See your plan documents: Here are the plans you are currently enrolled in through EMI Health. From here, you can view your plan documents (your coverage grids and/ or fee schedules if applicable) and access your pharmacy tools.

- View and sort your recent claims: Use the toggles to filter and sort your claims by type, covered member, network, and date range. View your Explanation of Benefits (EOBs) documents by clicking on “View EOB” to the right of each claim. Note: These

documents are not mailed, so it’s important to check your dashboard regularly for any new EOBs that come into your account. - At-a-glance accumulators: In this block, you can see your progress towards applicable plan accumulators for medical and dental plans. Use the drop-down options at the top to switch between covered members on your plan, time period, and accumulator type.

Find a Provider

Using in- network providers and facilities gets you the most coverage for healthcare services and saves you money.

Cigna PPO Network Provider Search

As a member of EMI Health, you have access to the nationwide Cigna PPO network of doctors, hospitals, and other facilities. You have access to in-network providers everywhere you go in the United States, helping you save money and protecting you from getting balance billed.

- Select Medical, Dental, or Vision depending on the type of provider you are looking for.

- Enter your plan name and state

- For Medical, select EMI Health Care Plus, For Dental or Vision, select the network found on your ID card.

Select your state from the drop-down list and/or input your ZIP code.

- For Medical, select EMI Health Care Plus, For Dental or Vision, select the network found on your ID card.

- Click on the Logo that matches your ID Card. If you see the pop-up, click on the logo found on your ID card to be redirected to their provider search tool.

- Follow the prompts. Use the steps to the right to view accurate results.

- View and filter your results

You’ll see your provider search results and you’ll be able to see where the providers/facilities are located, specialties, and other useful information to help you make your healthcare decisions.

Telemedicine

Reach a doctor 24/ 7/ 365.

70%of doctor visits can be handled over the phone, and 40%of urgent care visits can be managed using TeleMedicine. Save time and money while still getting the treatment you need through EMI Health TeleMed offered through Recuro.

When to Use TeleMed

Recuro doctors diagnose acute, non- emergent medical conditions and prescribe medications when clinically appropriate.

Speak with a doctor anytime and pay no consultation fee rather than paying the high costs associated with office visits, urgent care visits, and emergency room visits. Doctors are available by phone 24/7 and by video calls from 7 AM – 7 PM.

Benefits Guide

This benefits guide offers a wealth of information on your health benefits with Teachers Health Trust and EMI Health. From detailed coverage insights to wellness tips and updates, this resource empowers you to make informed decisions for your well-being.

Members on this plan are eligible for a Flexible Savings Account (FSA) through American Fidelity.

COBRA payments are managed exclusively by WEX Inc. For more information, visit the COBRA page.

Medical Benefits

The EMI Plan is a traditional PPO plan with set copays and deductibles residing in Clark and Nye County. THT does not require a referral to see a specialist, however, the specialist may require one. All services are subject to the EMI Health Maximum Allowable Charge. When using a Non-participating Provider, the Covered Person is responsible for all fees in excess of the Maximum Allowable Charge.

Members on the EMI plan are on a calendar year, meaning that deductibles reset annually on January 1. Additionally, they will have their own open enrollment period separate from the general membership. The EMI Open Enrollment typically takes place in November.

| In-Network | Out-of-Network | |

|---|---|---|

| General Information | ||

| Annual Out-of-Pocket Maximum Individual / Family |

$7,500 / $15,000 | $7,500 / $15,000 |

| Annual Medical Deductible Individual / Family |

$500 / $1,500 | $1,500 / $4,500 |

| Physician & Professional Services | ||

| Convenience Clinic | $40 | 50% |

| Primary Care | $15 | 50% |

| Secondary Care | $30 | 50% |

| Physician Visits | 20% | 50% |

| Surgery | 20% | 50% |

| Anesthesiology | 20% | 50% |

| Rehabilitation Therapy | $30 | 50% |

| Chiropractic Therapy | $30 | 50% |

| Acupuncture Services | $30 | 50% |

| Allergy Testing | 20% | 50% |

| Hospital/Facility Benefits | ||

| Medical/Surgical Care (Outpatient) | 20% | 50% |

| Emergency Room (ER) | $300 | $300 |

| Urgent Care Clinic | $30 | 50% |

| Preventive Care | 0% | 0% |

Dental Benefits

Download the Benefits Summary| In-Network (Advantage Plus Network) |

In-Network (Premier Network) |

Out-of-Network | |

|---|---|---|---|

| Type 1 – Preventive Oral Exams, Cleanings, X-rays, Fluoride |

100% | 100% | 100% up to MAC* |

| Type 2 – Basic Fillings, Oral Surgery, Endodontics, periodontics, Sealants, Space Maintainers |

80% | 80% | 80% up to MAC* |

| Type 3 – Major Crowns, Bridges, prosthodontics |

60% | 60% | 60% up to MAC* |

| Type 4 – Orthodontics Dependent children ages 7 through 18 |

50% | 50% | 50% up to MAC* |

| Adults | Discount Only | Discount Only | No Coverage |

| Annual Maximum Per Person | $2,000 | $1,500 | $1,500 |

*All Services are subject to EMI Health Maximum Allowable Charge (MAC). When using a Non-participating Provider, the insured is responsible for all fees in excess of the Maximum Allowable Charge (MAC

Vision Benefits

Download the Benefits Summary| In-Network | Out-of-Network | |

|---|---|---|

| WellVision Exam | $10 Copay | Up to $65 |

| Lenses (Glass or Plastic) | ||

| Single Vision | $10 Copay | Up to $30 |

| Lined Bifocal | $10 Copay | Up to $50 |

| Lined Trifocal | $10 Copay | Up to $65 |

| Lenticular | $10 Copay | Up to $100 |

| Lens Options | ||

| Progressive (Standard no-line) | $0 Copay | Up to $50 (In lieu of Lined Bifocal reimbursement) |

| Premium Progressive Options | $95-$105 Copay | Up to $50 (In lieu of Lined Bifocal reimbursement) |

| Custom Progressive Options | $150-$175 Copay | Up to $50 (In lieu of Lined Bifocal reimbursement) |

| Plastic Gradient Dye | $17 Copay | N/A |

| Solid Plastic Dye | $15 Copay | N/A |

| Photochromic Lenses | $75 Copay | N/A |

| Polycarbonate for Adults | $31 Copay SV/$35 Copay Multifocal | N/A |

| Polycarbonate for Children (under 18) | $0 Copay | N/A |

| Coatings | ||

| Scratch Resistant Coating | $17 Copay | N/A |

| Anti-Reflective Coating | $41 Copay | N/A |

| UV Protection | $16 Copay | N/A |

| Additional lens enhancements | Up to 25% Discount | N/A |

| Frames | ||

| Allowance Based on Retail Pricing | $130 Allowance at any VSP doctor or $70 at Costco, Sam’s Club or Walmart |

Up to $80 |

| Additional Pairs of Glasses** | Up to 20% Off Retail | N/A |

| Elective Contact Lenses In Lieu of Frame & Lenses | ||

| Elective contact lens fitting, evaluation services and prescription contact lenses are covered up to plan allowance. 15% discount given off contact lens fitting and evaluation services, excluding materials. | $130 Allowance | Up to $115 |

| Frequency | ||

| Exam, Lenses, Frame or Contacts | ||

| Refractive Surgery | Up to $500 in Savings | Not Covered |

This is a summary of plan benefits. The actual Policy will detail all plan limitations and exclusions** 20% discount off unlimited additional pairs of glasses offered through any VSP Choice Providers within 12 months of last covered eye exam.*** Discounts average 15-20% off or 5% off a promotional offer for laser surgery, including PRK, LASIK, Custom LASIK, and IntraLase3

Pharmacy Benefits

| Participating Pharmacy (up to 30 day supply) |

Non-Participating Pharmacy | Mail Order (up to 90 day supply) |

|

|---|---|---|---|

| Generic | $15 | Not Covered | $40 |

| Preferred | 25%, up to $100 | Not Covered | 25%, up to $300 |

| Non-Preferred | 40% | Not Covered | 40% |

| Specialty Pharmacy (up to 90 day supply) All fills must be purchased through Express Scripts Specialty Pharmacy. |

25%, up to $1,500 | n/a | n/a |

| Specialty Pharmacy SaveOnSP Program 1-800-683-1074 http://emihealth.com/pdf/saveon.pdf |

$0 Copay After Enrolling | n/a | n/a |